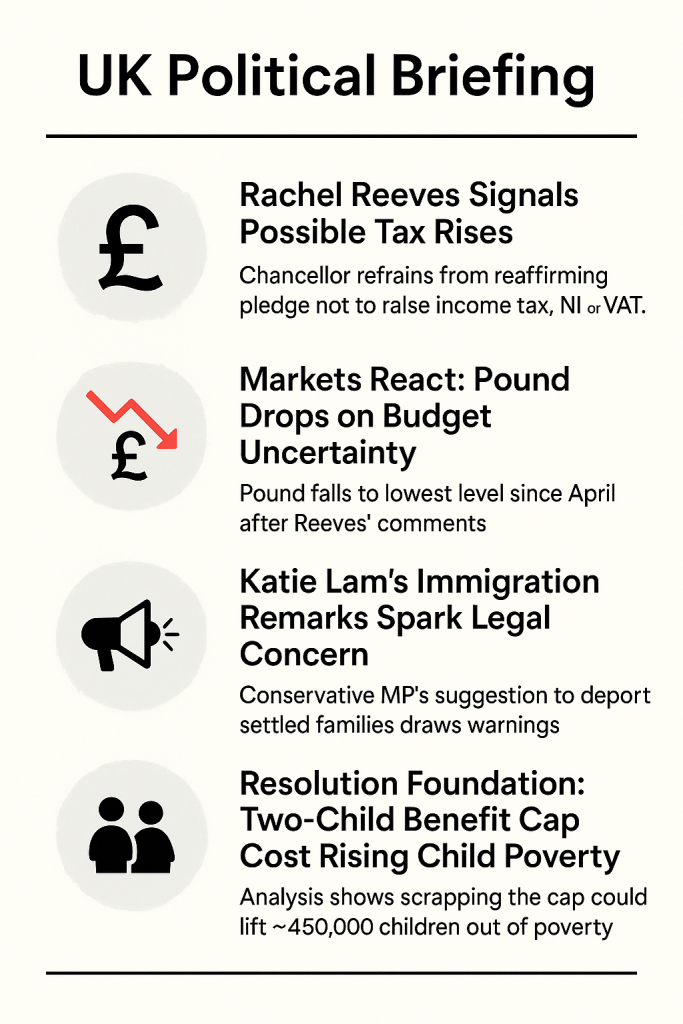

Key Developments & Why They Matter

1. Rachel Reeves signals possible tax rises

The Chancellor avoided reaffirming the manifesto pledge not to raise income tax, national insurance or VAT, citing economic realities.

Why it matters: This signals a major shift in fiscal strategy under the current government, raising the possibility of higher taxes or reduced benefits.

Practical note: Pensioners and households should be alert — tax changes or benefit freezes could affect disposable income and cost‑of‑living.

2. Markets react: Pound drops on budget uncertainty

The pound hit its lowest since April after the Chancellor’s remarks, reflecting investor concern over borrowing and tax policy.

Why it matters: Currency weakness can translate into higher import costs (fuel, food) and inflationary pressure, impacting living costs.

Practical note: For cruisers or overseas trips, currency shifts could affect travel budgets and spending abroad.

3. Katie Lam’s immigration remarks spark legal concern

A Conservative MP suggested deportation of legally settled families to maintain “cultural coherence”; legal experts warned this is a dangerous shift.

Why it matters: It signals an escalation in immigration rhetoric and could foreshadow policy changes affecting settled migrants and their dependants.

Practical note: If you have family or friends settled from abroad (or conduct travel with such links), check how any policy drift might affect immigration or residence rights.

4. Resolution Foundation: two‑child benefit cap cost rising child poverty

Analysis shows abolishing the two‑child benefit cap could lift ~450,000 children out of poverty — yet the government is reluctant to act.

Why it matters: This highlights tension between social policy (child poverty, welfare) and fiscal constraints — affecting how benefits are distributed.

Practical note: While this may not directly affect retired couples immediately, shifts in welfare could reallocate government spending away from other areas (e.g., public services) that you use.

5. Welfare reforms becoming politically fraught Linked to the benefit cap issue, the government appears wary of large‑scale welfare reversal despite social need, due to cost and fiscal risk.

Why it matters: The delay or avoidance of reforms could mean welfare pressures increase, public services demand rises, and long‑term fiscal burdens mount.

Practical note: If you rely on public services (healthcare, social care) the strain on funding and resources may affect service quality or availability.

Summary

Today’s UK political scene shows fiscal caution turning into potential tax rises, currency pressure, increased immigration posturing, and stalled welfare reforms. For pensioners and households, this means watching tax/benefit changes, possible upward pressure on imported goods and travel expenses, and keeping an eye on public service funding.

Infographic for today